BUY CREDIT MANIA BOARD GAME

How Can We Help

Credit mania board game is a creative and engaging way to learn about credit scores. Our Key Components are:

GATHER CREDIT POINTS AND MAKE PROFIT, BUT PAY ATTENTION TO THE DEBT, Which can make you go bankrupt! Resolve life cards: they may be helpful or not! Score CP points from purchased assets, events and life cards and show who is the best in CREDIT MANIA, a competitive board game that is so educational and fun!

Pay bills on time, and avoid common pitfalls like overspending and taking on too much debt.

The game also includes helpful tips and advice for improving credit scores, making it a valuable tool for anyone looking to improve their financial literacy.

Credit mania board game is a fun and effective way to learn about credit scores and financial management.

Credit mania board game is a creative and engaging way to learn about credit scores. The game is designed to teach players how to manage their finances and improve their credit score. The game is set up like a traditional board game, with players moving around the board and completing various challenges and tasks.

Credit mania board game is a creative and engaging way to learn about credit scores. Our Key Components are:

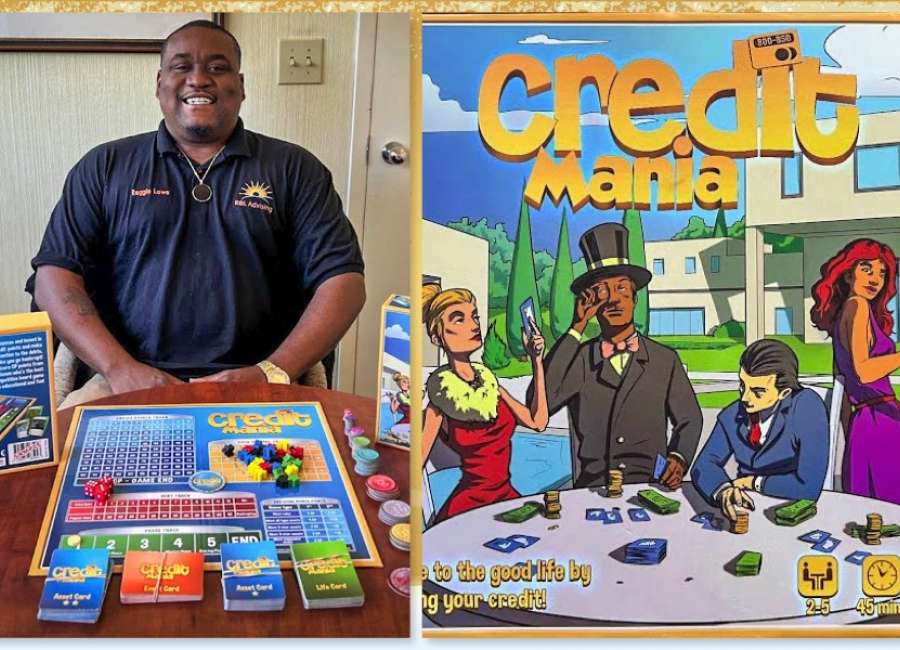

Coweta native and credit guru Reginald ”Reggie” Lowe is on a mission to help as many people increase their credit score, and he wants to help youth get the information early with his new board game, Credit Mania, which teaches the fundamentals of credit.

Lowe started in business in December 2018.. He said it all started from wanting to purchase a home and finding out there was some inaccurate information on his credit report that was holding him back. He said he spent months fixing his own credit to really learn the process. Lowe said he wanted to be a trusted advisor for his future clients.

”I knew one day I was going to do it better after I mastered it. People started writing to me on Facebook asking me on Facebook asking me to help them.”

Lowe said he started his business with barely any supplies or very little money. His office space was literally the nearest library. He started charging like $199 meeting clients at the nearest library. He resigned from his job at Yamaha and thus R&L Advising was born.

In the game, players take on the role of borrowers and lenders, and they must navigate through various financial situations to build their credit score. They must make timely payments, avoid maxing out their credit cards, and manage their debt to maintain a good credit score. This interactive approach to learning about credit score makes it easier for players to understand the importance of good credit and how it can impact their financial future.

You want to reach us or want help from us please feel free to contact us any time no need to hesitate thinking about anything.

No products in the basket.